In a strategic move that is set to reshape the landscape of the biopharmaceutical industry, Pfizer has announced its monumental $43 billion acquisition of Seagen. This landmark deal marks a significant step forward, propelling the company into new realms of innovation and therapeutic development.

Background

Pfizer, headquartered in New York, has long been a major player in the pharmaceutical sector, with a rich history of groundbreaking discoveries and transformative medical solutions. Seagen, on the other hand, based in Bothell, Washington, is renowned for its pioneering work in oncology, particularly in the development of targeted cancer therapies. The merger of these two industry giants promises to usher in a new era of medical advancements and enhanced patient care.

Strategic Implications

The acquisition of Seagen is more than just a financial transaction; it represents a strategic move by Pfizer to strengthen its position in the competitive biopharmaceutical market. Seagen’s expertise in cancer research and therapies aligns seamlessly with Pfizer’s commitment to advancing treatments for some of the most challenging medical conditions.

“Given Seagen’s position as the best ADC company, we are confident they are the ideal partner for Pfizer,” said Albert Bourla, Pfizer’s CEO, said during a conference call. “Pfizer is ideally situated to deploy our financial, scientific, manufacturing and commercial capabilities to develop far more new medicines with Seagen’s targeted technology.”

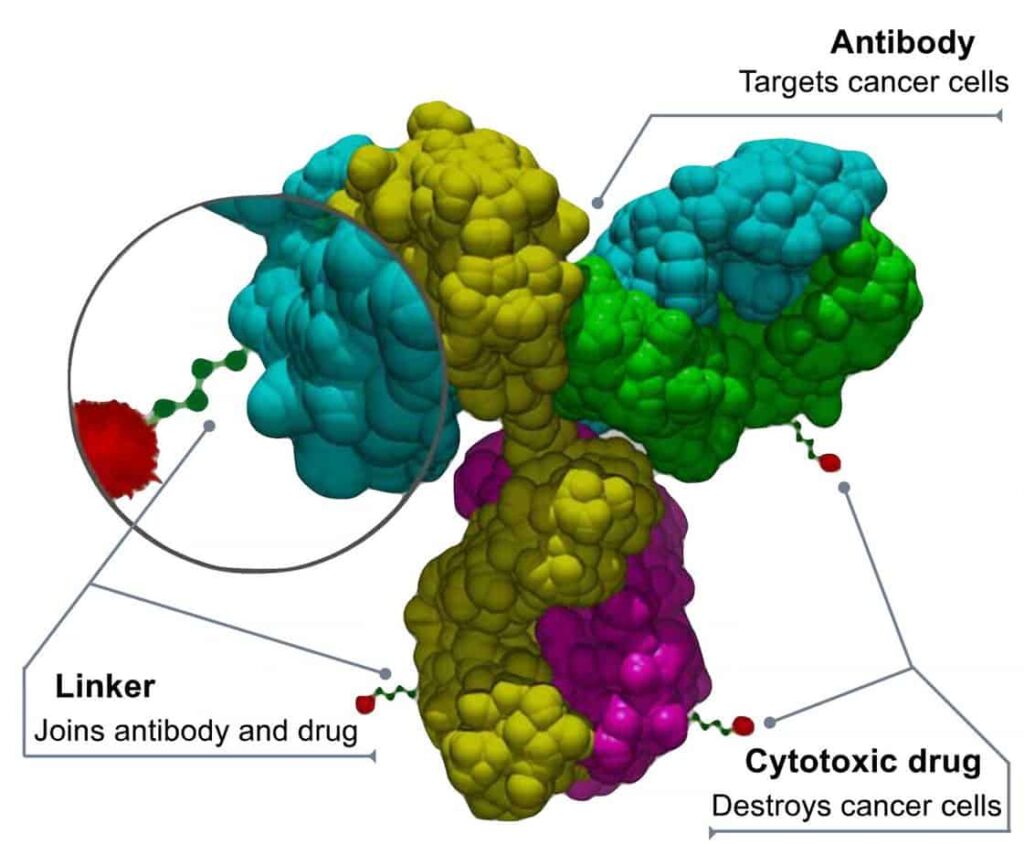

With this acquisition, Pfizer gains access to Seagen’s impressive portfolio of cancer therapies, including antibody-drug conjugates (ADCs) that have shown remarkable efficacy in clinical trials. This strategic alignment is expected to drive synergies in research and development, ultimately leading to the creation of more targeted and effective treatments for cancer patients worldwide.

Financial Landscape

The $43 billion price tag attached to the Seagen acquisition underscores the scale and significance of this deal. Pfizer’s financial strength and global reach position it well to absorb Seagen into its expansive portfolio seamlessly.

According to Burla, “In addition to expanding our portfolio and leading the next generation of cancer breakthroughs, we also expect Seagen to contribute meaningfully to our goal of accelerating near-term and long-term financial growth.”

The financial terms reflect not only the current value of Seagen but also the potential future value that Pfizer anticipates through the development and commercialization of Seagen’s innovative therapies.

Market Impact

The pharmaceutical industry is no stranger to mergers and acquisitions, but the Pfizer-Seagen deal stands out due to its potential to reshape the landscape of cancer therapeutics. This acquisition positions Pfizer as a formidable force in the oncology space, allowing the company to diversify its offerings and provide more comprehensive solutions for patients grappling with various forms of cancer.

Patients and Healthcare Professionals

One of the most critical aspects of this acquisition is its impact on patients and healthcare professionals. By joining forces, Pfizer and Seagen can accelerate the development and availability of cutting-edge cancer treatments. This, in turn, offers hope to patients and healthcare providers who are constantly seeking better and more targeted solutions to combat the complexities of cancer.

Global Reach and Collaboration

As Pfizer expands its footprint in the oncology sector through the Seagen acquisition, the global impact of this collaboration cannot be overstated. The pooling of resources, expertise, and research capabilities creates a platform for accelerated innovation and breakthroughs in cancer research. This global collaboration is expected to benefit patients not only in the immediate future but also in the long term as the combined efforts of Pfizer and Seagen yield novel therapeutic approaches.

Regulatory Considerations

While the acquisition has been announced with enthusiasm and anticipation, it is crucial to acknowledge the regulatory landscape that governs such transactions. Pfizer will need to navigate the regulatory approval processes to ensure a smooth integration of Seagen into its operations. This includes addressing any potential antitrust concerns and securing the necessary approvals from regulatory bodies overseeing pharmaceutical mergers.

Conclusion

However, as Pfizer and Seagen join forces, the potential for groundbreaking discoveries and transformative cancer therapies becomes ever more promising. The impact of this acquisition extends beyond the boardrooms and balance sheets; it holds the promise of better, more targeted treatments for cancer patients globally, reaffirming both companies’ dedication to advancing healthcare and improving lives.